✅ Medicare Next Steps

A Simple Roadmap to Help You Enroll with Confidence

Whether you're just starting to explore Medicare or already have your enrollment date in mind, this guide walks you through each step of the process—so you know exactly what to do and when to do it.

🗓️ Step 1: Know Your Medicare Timeline

Enrolling at the right time helps avoid gaps in coverage and late penalties. Here's a quick overview of the key enrollment periods:

📌 Initial Enrollment Period (IEP)

Begins 3 months before your 65th birthday

Includes your birthday month

Ends 3 months after your birthday

🎯 Enroll early to ensure coverage starts when you need it!

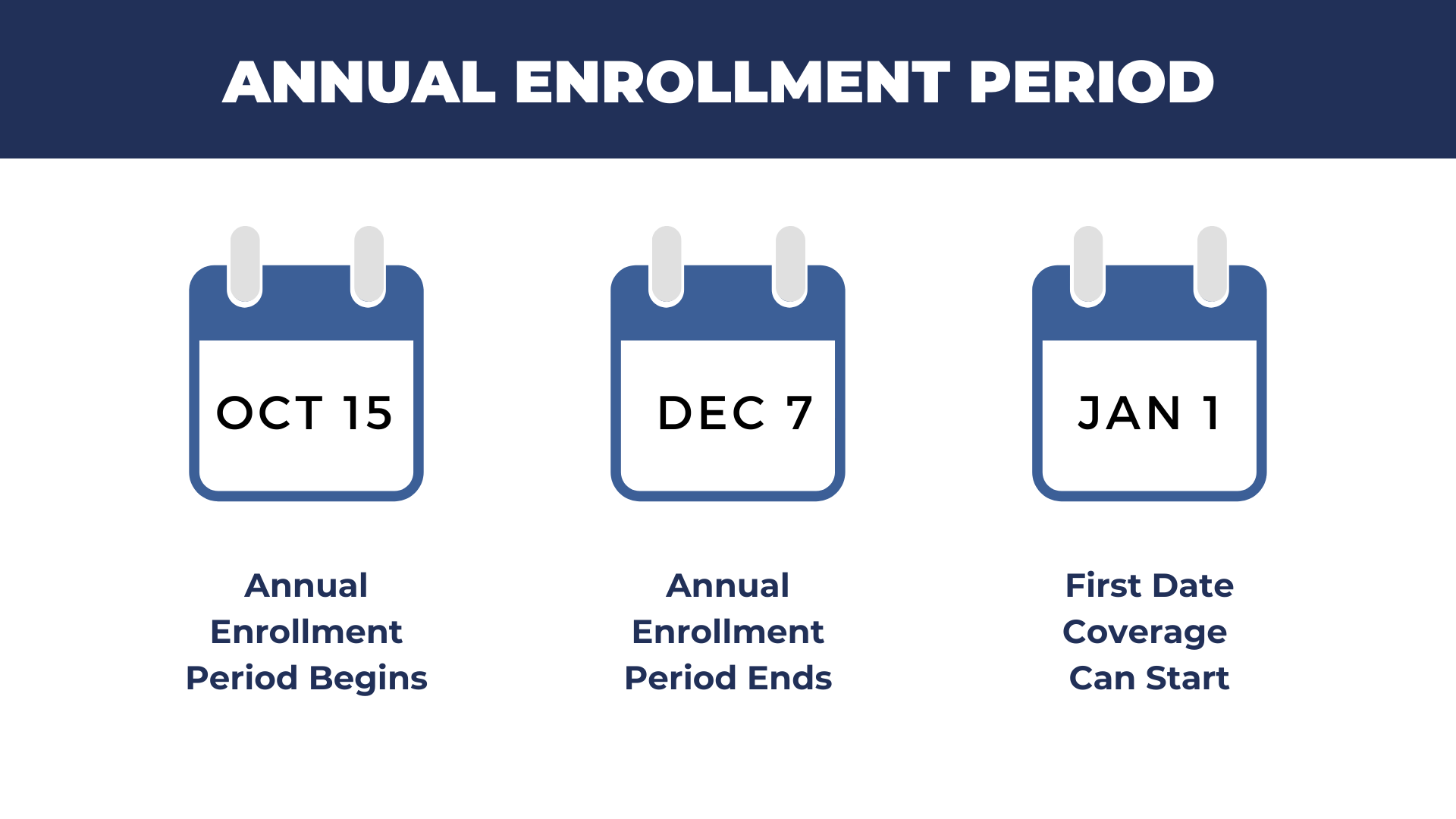

📆 Annual Enrollment Period (Oct 15 – Dec 7)

Each year, this is when all Medicare beneficiaries can:

Join, switch, or drop Medicare Advantage or Part D plans

Changes take effect January 1

🧾 Special Enrollment Periods (SEPs)

Certain life events give you a chance to enroll or change coverage outside of normal windows:

Retiring and losing employer coverage

Moving to a new area

Becoming eligible for Medicaid or Extra Help

Let us help you find out if you qualify.

Apply for Medicare

Apply for Medicare

📝 Step 2: Apply for Medicare

Ready to apply? You can do it yourself—or we’ll walk you through it!

Apply here: SSA.gov/medicare/sign-up

🎥 Step 3: Request a Medicare Basics Webinar

Before we meet, get familiar with the basics. (Coming Soon!)

Watch now: Request the Free Medicare 101 Webinar (Coming Soon!)

⚠️ Disclaimer:

By watching this video, you are not enrolling in any Medicare plan or committing to any type of coverage. This educational presentation is for informational purposes only and does not constitute a sales event. No specific plan benefits or carrier recommendations will be discussed unless requested by you during a personal consultation.

✍️ Step 5: Choose Your Plan & Get Enrolled

Once you decide what works best, we’ll complete the application together and ensure it’s submitted correctly.

These are just some of the many Medicare-approved carriers we work with. If you don’t see the company you’re interested in, please don’t hesitate to reach out—we may still be able to help! Carrier availability varies by location and plan type.

🔄 Step 6: Annual Support & Reviews

You’re never left to figure it out on your own. We provide:

Yearly plan reviews during Open Enrollment

Help with changes, questions, and savings

Ongoing support when you need it

⚠️ Don’t Miss These Deadlines: Medicare Late Enrollment Penalties

Enrolling at the right time isn’t just smart—it can save you money for the rest of your life. If you wait too long to sign up for certain parts of Medicare, you could face permanent late enrollment penalties.

💸 Part B Late Enrollment Penalty

If you don’t sign up for Medicare Part B when you’re first eligible, and you don’t have other creditable coverage (like employer insurance), you’ll pay a penalty.

What it is: An additional 10% added to your monthly Part B premium for every full 12 months you delayed enrollment.

How long it lasts: The penalty is permanent—you’ll pay it for as long as you have Part B.

🧠 Example: If you wait 2 years to enroll, you’ll pay 20% more on your premium for life.

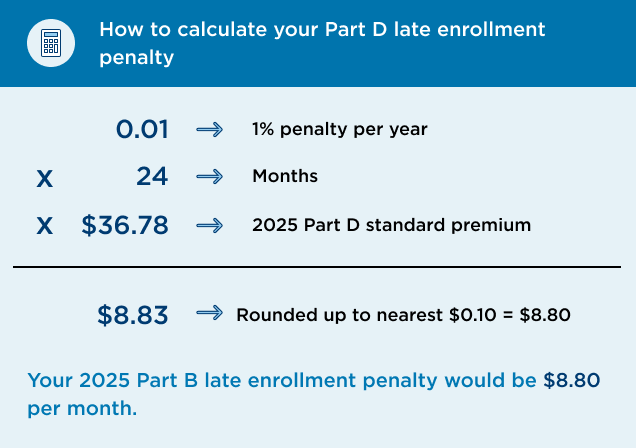

💊 Part D Late Enrollment Penalty

If you delay enrolling in prescription drug coverage (Part D) and go 63 or more days without creditable coverage, you’ll face a penalty.

What it is: 1% of the national base premium (about $34.70 in 2024) multiplied by the number of months you were without coverage.

How long it lasts: You’ll pay this penalty as long as you have a Part D plan.

🧠 Even if you’re not taking any prescriptions now, it’s wise to enroll in a basic drug plan to avoid this penalty.

✅ How to Avoid Penalties

Enroll during your Initial Enrollment Period (IEP)—the 7-month window around your 65th birthday.

If you’re still working and have employer coverage, be sure to verify that it counts as creditable coverage.

If you’re unsure, contact us—we can review your current situation and help you avoid costly mistakes.

The information provided on this website is intended to help you better understand your Medicare choices. While it is based on publicly available sources such as Medicare.gov and the Centers for Medicare & Medicaid Services (CMS), this content has been created by Peterson Insurance Solutions, operating under the brand Faithfully Planned. We are not affiliated with or endorsed by the federal government or the Medicare program. For personalized advice, please consult official resources or speak directly with a licensed insurance agent.